504 Loans – Financing to help small businesses succeed!

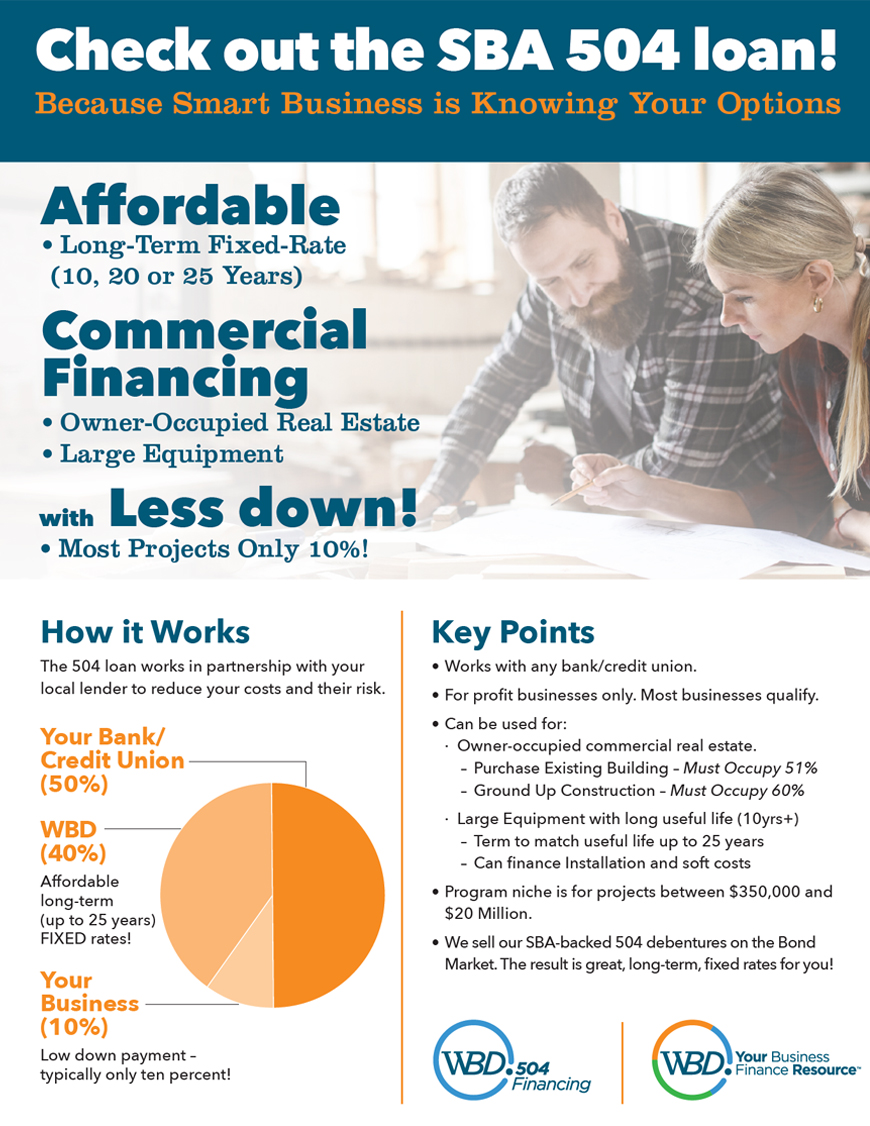

An SBA 504 loan is a special product that can only be offered by a Certified Development Company (CDC) in partnership with a local lender. WBD is one of the most successful CDC’s in the country and has partnered with hundreds of local lenders to help thousands of small businesses since 1981.

The 504 loan is designed to help small businesses grow and create jobs by financing fixed assets like real estate and equipment. This program is best suited for projects from about $250,000 - $20,000,000.

Qualified borrowers can look forward to:

- Long terms (25 years for real estate, 10 years for equipment)

- Low, fixed rates (see top of page for current rate)

- Lower down payments (10%)

One of the greatest advantages of this 504 program is that it helps get financing deals done that conventional lenders are hesitant to tackle alone. In addition to the favorable terms for the borrower, partnering with WBD also reduces risk for the lender as well.

If all of this sounds good, take three minutes to view the “What is a 504?” video to learn more about how this powerful program works.