Over the past decade, there has been a noteworthy 22% surge in privately-held companies embracing Employee Stock Ownership Programs (ESOPs), encompassing approximately 14 million employees in the United States. But what exactly is an ESOP, and what are the advantages it offers?

In essence, an ESOP grants workers ownership stake in the company as part of their overall compensation package, typically in the form of retirement assets. This arrangement provides employees with an additional incentive, as the success of the company can lead to financial rewards for the individual. On average, employees in ESOP companies boast retirement account balances 2.2 times higher than those in non-ESOP companies.

Beyond the benefits to the employee, there are substantial advantages for the employer as well. ESOPs can serve as a potent tool for recruiting, retaining, and motivating employees—a challenge that virtually every business has faced in recent years. Additionally, there are tax benefits for both the company and its employees. Contributions to ESOPs are tax-deductible for the company, while employees can accrue wealth in their ESOP accounts tax-deferred until retirement or departure from the company.

While there are numerous benefits to this ownership structure, financing can be a bit tricky due to the fact that loans to ESOPs are most often non-recourse, meaning the lender can't pursue anything other than the collateral for repayment of debt.

Consequently, a traditional financing structure may necessitate a larger down payment to put the lender in a more comfortable collateral position. Alternatively, the use of the 504 program can save ESOP companies substantial up front costs and mitigate potential risk for the lender.

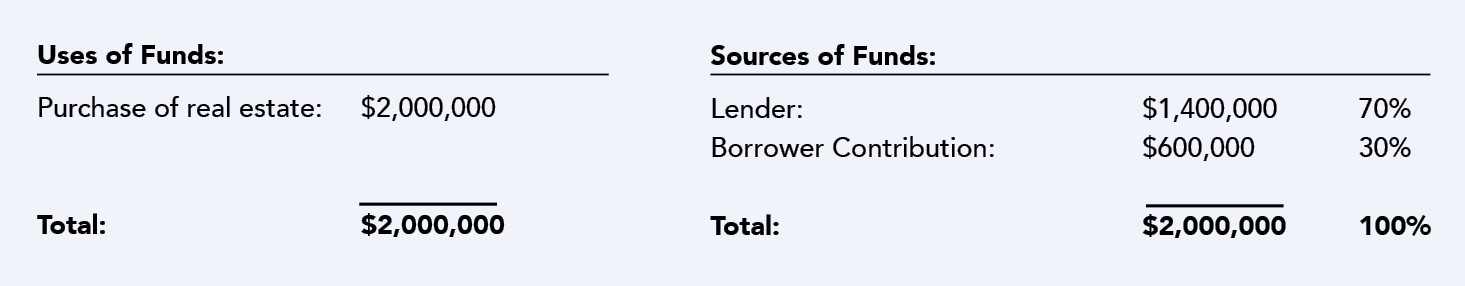

As an example, consider a manufacturer looking at a $2,000,000 real estate purchase. Under conventional financing, the lender may seek a 30% down payment to mitigate their collateral risk. This would require the company to inject $600,000 of business cash into the transaction, leaving the lender with a 70% loan-to-value ratio on the property.

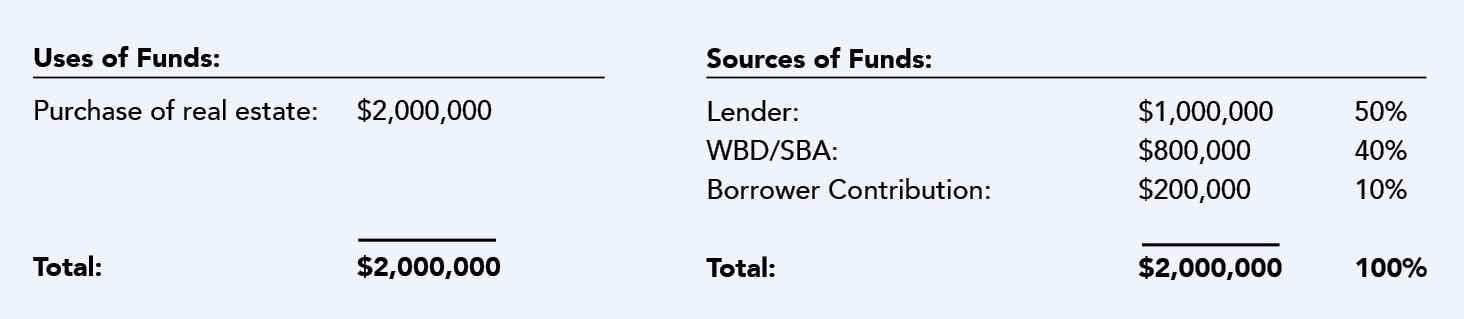

Now, let's examine the same scenario with a 504 loan structure. In this case, the borrower would only need to inject 10% into the project, saving the remaining $400,000 for the continued growth of the company. Additionally, the lender would end up with a collateral position of 50% loan-to-value—a true win-win financing solution for both the company and the lender.

It’s estimated that two-thirds of all privately-held companies are currently owned by Baby Boomers (ages 60-78), with over 80% expected to change hands within the next 5-10 years. The rise in ESOP formations is projected to continue into the foreseeable future, emphasizing the need for funding solutions to help these companies transition successfully into the next phase of ownership. The SBA 504 program can be a great tool to assist in their success.