To keep you informed and help you better navigate through the SBA process, we answer a few customer questions we've recently received.

1. Q: We are looking at a deal where we are doing three 7(a) loans with EPC/OC structures. Two of the three properties are being sold by the same seller and same Purchase Agreement and will likely close on the same day. Are we required to cross collateralize the real estate on those loans even though we meet the SBA concept of fully secured for that real estate asset purchase (all operating company assets are pledged as well)? In addition, the third will be coming shortly after that. Do we need to cross collateralize the real estate assets with the first two?

A: If all three of the new loans will be 7(a), SBA would not require them to be cross-collateralized. The following is from page 113 of the SOP 50 10 7.1:

A Lender may not take any action in connection with an SBA-guaranteed loan that establishes a preference in favor of the Lender (13 CFR § 120.411). The Lender must not have a 7(a) loan in a “piggyback” structure.

a. Piggyback financing occurs when one or more lenders provide more than one loan to a single Borrower at or about the same time, financing the same or similar purpose, and where the SBA-guaranteed loan is secured with a junior lien position or no lien position on the collateral securing the non-guaranteed loan(s). SBA considers “at or about the same time” to mean loans approved within 90 days of each other.

b. SBA does not consider a scenario where both the SBA-guaranteed loan and the non-SBA guaranteed loan are for working capital and the non-SBA guaranteed loan is secured only by working/trading assets to be a piggyback structure.

c. SBA does not consider a shared lien position with the lender (pari passu) to be a piggyback structure when the maturity of the non-SBA guaranteed loan is not shorter than the maturity of the SBA-guaranteed loan.

Again, the “piggyback” issue only comes into play if there is a conventional loan done within 90 days of a 7a loan and both loans finance a similar purpose. But if all of the new loans you are doing will be 7a, you would not have a piggyback issue. It’s possible that the bank could have an internal requirement for the 3 loans to be cross collateralized from an internal underwriting standpoint.

2. Q: If a 7(a) loan has a portion of the proceeds going to leasehold improvements, are we required to do an environmental review? I am wondering if “improved by loan proceeds” qualifies as leasehold improvements.

A: Environmental due diligence is only required on properties that are being taken as collateral for the 7(a) loan. So if the improvements are being done on a property owned by the applicant business or related entity, then an environmental review would be required. But if the improvements are being done on a property that the borrower leases from a 3rd party, then an environmental review would not be needed.

3. Q: Quick question - I’m assuming we don’t need to create Express Authorizations anymore? Does SBA create a T&C form for Express deals now?

A: You are correct that Express Authorizations are no longer required. That requirement went away 8/1/23 when SBA went from using an Authorization to the Terms and Conditions document for all 7(a) loans including Express.

For any loan type (Express, PLP or GP), you would go into Etran Servicing after the SBA has issued a loan number and click the blue Terms and Conditions button. If there is anything that needs to be updated, you would make the change in Etran Servicing and repull the Terms and Conditions document.

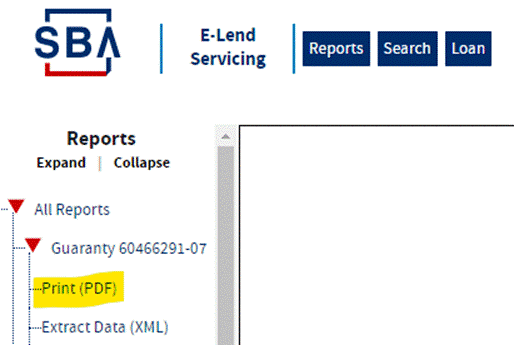

Because the Terms and Conditions is so brief, when WBD packages a loan we provide a printout of everything that was in the Etran application so the lender has that for their file. You can do that by clicking the blue Reports button in Etran servicing:

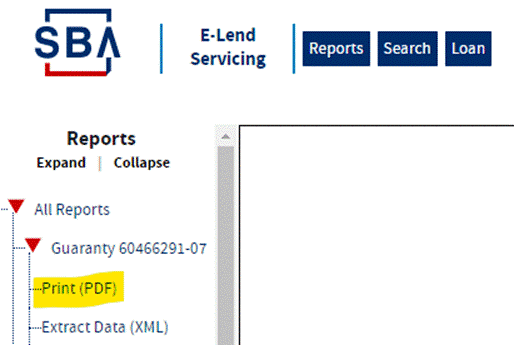

Then click Print (PDF) from the menu on the left: