If you are working with a member of our team on a 504-transaction financing a straight purchase of real estate, or on a 504-debt refinance project, the term “Simultaneous Closing” may be brought up. We’ve been offering Simultaneous Closings for several years. While it requires a little more upfront coordination, it streamlines the 504-loan closing & funding process, makes things easier for your borrowers, and can take up to 30 days off the 504-funding timeline.

Let's start with a short explanation for those of you who haven’t had the opportunity to work through a simultaneous closing on a 504 transaction. Like all 504 projects, you, as the Third-Party Lender, still need to provide the interim financing. Essentially, with a simultaneous closing, WBD will just tag along with you at your interim loan closing. After documents are signed, WBD’s team goes to work behind the scenes, to get the closing package ready to submit to the SBA to fund the 504 debenture and lock your borrower’s fixed rate.

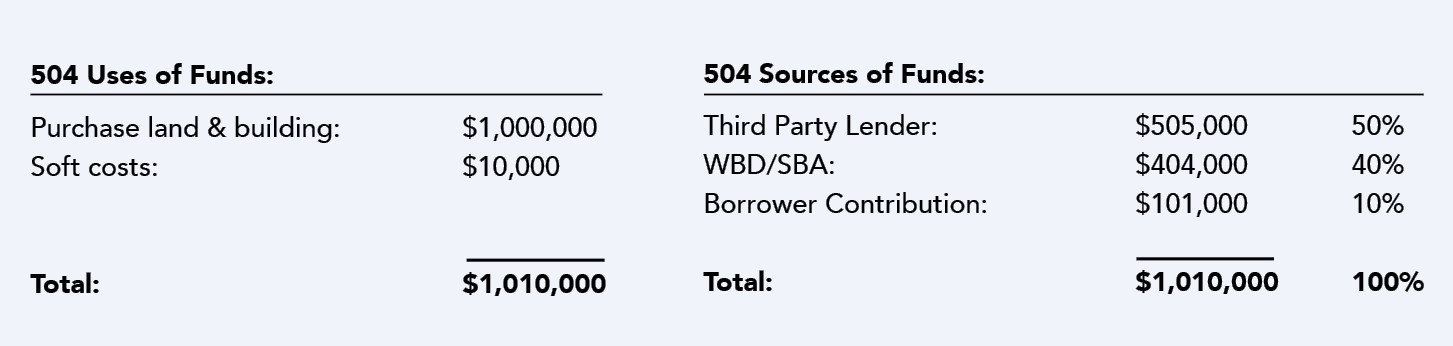

With a simultaneous closing, WBD recommends your financial institution set up an “A note” / “B note” type structure. Let’s say we are financing the purchase of a building for $1,000,000 and the borrower qualifies for 10% down.

The 504 structure would look like this, rolling in some eligible closing / soft costs:

Your financial institution would document and close two separate notes / mortgages:

- Permanent first Mortgage note of $505,000:

- Needs to carry a minimum term / maturity date of 10 years at whatever rate and amortization approved by your financial institution.

- Second Mortgage Interest only note of $404,000:

- Typically, on a straight purchase of real estate or on a debt refinance project, WBD would recommend a minimum term / maturity date of 4 months on this note to allow time for the 504-debenture sale.

WBD offers and highly recommends you provide a draft of your loan documents, title commitment, and a draft of the closing / settlement statement in advance of closing.

Fast forward to the closing table…WBD would have the 504-closing package ready to sign the same day you are signing your permanent first mortgage note and second mortgage interest only note. While your borrower will have more documents to sign on this closing day, there is no need for another meeting to sign the 504-closing package.

After closing, WBD’s team goes to work buttoning up the file, getting our final title in place, etc. to submit to SBA. This is all behind the scenes. Typically, ~45 days later, your financial institution gets the wire to pay off the second mortgage interim note and your borrower’s 20- or 25-year fixed rate is locked in.

Here’s a real-life example that I recently worked on. The project financed a business acquisition, with the 504 just financing the real estate as a part of the overall structure. The timeline of events were as followed:

- SBA Approved the 504 Loan Application on 4/15/24.

- Closing was set for 5/1/24:

- Simultaneous closing with the Third-Party Lender

- 504 Closing Package Submitted to SBA on 6/1/24:

- Remember, SBA only accepts complete closing packages on the first business day of the month proceeding the debenture sale. When we say complete, this includes WBD/SBA’s final title policy, acknowledged life insurance assignment (if applicable), etc.

- 504 Rate Locked on 7/11/24.

- 504 Funding Occurred on 7/17/24:

- Date the Third-Party Lender received the wire to pay off their second mortgage interim loan.

- Borrower’s first payment due on the 504 loan on 8/1/24

A few helpful tips:

- If the borrower has a tight closing timeline, a simultaneous closing may not be feasible. WBD needs a week or so after the SBA Loan Approval is issued to prep the file and get our 504-closing package back from our closing attorney.

- Share a copy of your title commitment with WBD upon receipt. In most instances, we’ll piggy-back and use the same title company.

- Coordination with your loan processing team and WBD’s team is key. As mentioned, we will request to review your draft loan documents and the closing / settlement statement (if applicable) in advance of closing.

If you have questions about simultaneous closings, please contact your WBD loan office.